Category: Credit & Approval Strategies

-

The Impact of Credit Scores on Mortgage Approval: What You Need to Know

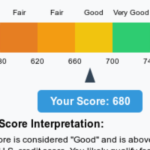

Your credit score is a critical factor in the mortgage approval process. It serves as a measure of your financial responsibility and directly influences your eligibility for a home loan, the interest rate you’re offered, and the terms of the loan. Whether you’re a first-time homebuyer or looking to refinance, understanding the role of credit

-

How to Improve Your Credit Before Applying for a Mortgage

Your credit score is a vital component of the mortgage application process. It’s a measure of your financial reliability and determines the terms lenders will offer, from interest rates to borrowing limits. A strong credit profile can save you thousands of dollars over the life of a loan, while a weak one can lead to

-

How to Secure a Low-Interest Mortgage Even with a Challenging Credit History

Securing a mortgage is a significant step toward homeownership, but for those with a challenging credit history, it can feel like an uphill battle. While a high credit score makes it easier to qualify for a low-interest mortgage, having less-than-perfect credit doesn’t mean you’re out of options. With the right strategies, persistence, and preparation, you

Recent Posts

- Why Credit Repair Is Becoming a Key Part of Financial Wellness

- How to Leverage Your Home Equity for Better Mortgage Rates

- Navigating the First-Time Homebuyer’s Mortgage Process

- The Impact of Credit Scores on Mortgage Approval: What You Need to Know

- Why Your Mortgage Application Could Be Denied and How to Fix It

Tags

credit repair credit repair affiliate program